Federal Tax Liens and How a Tax Attorney Can Assist

ME

Understanding Tax Liens

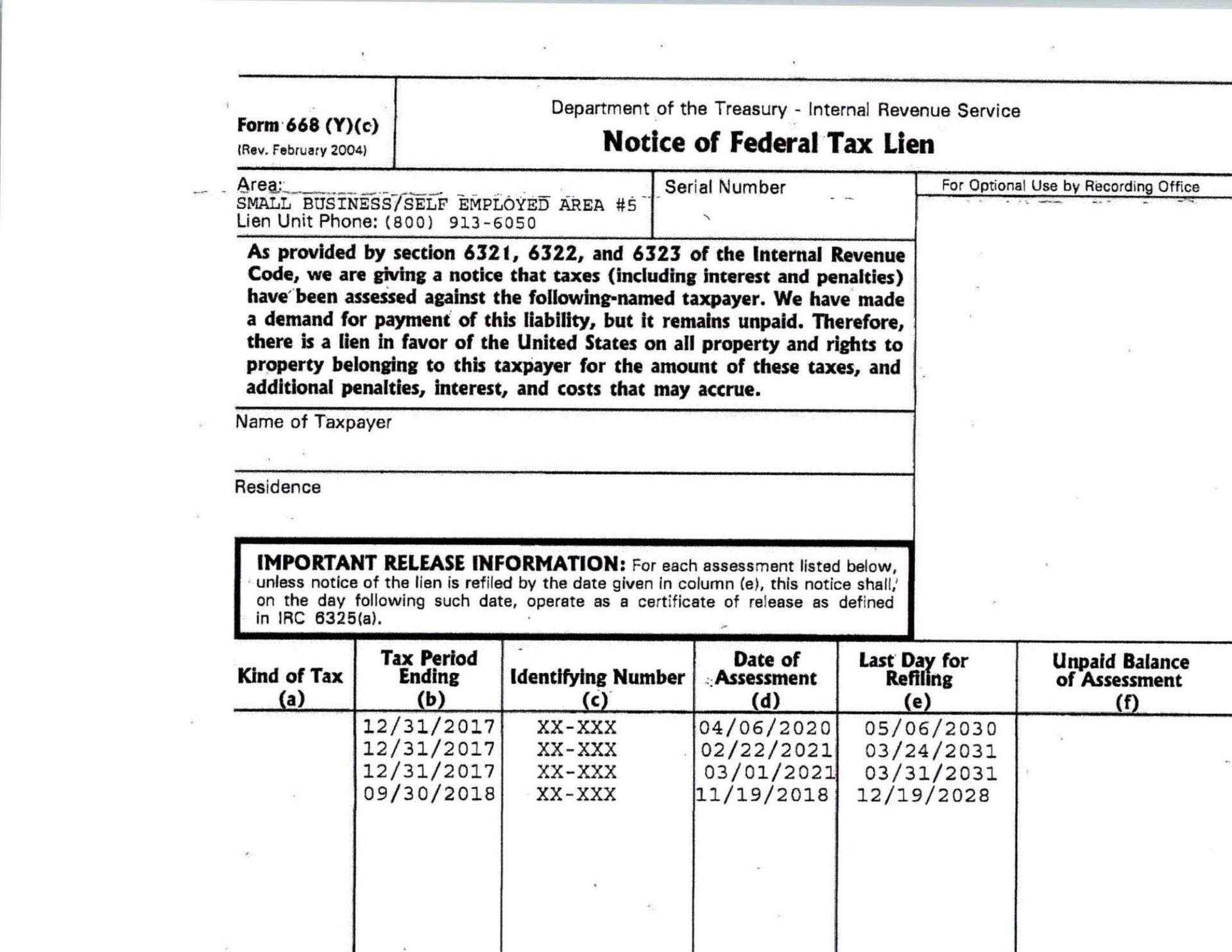

A federal tax lien can cause huge problems for taxpayers, especially when they apply for a loan or try to sell real estate in a county where a federal tax lien has been filed. Federal tax liens secure the IRS's interest in taxpayer assets until the tax debt is paid. See Understanding a Federal Tax Lien.

The tax lien is a passive collection tool, meaning it is a public notice to other potential creditors of the IRS lien, which affects your ability to get a loan and prevents you from selling or refinancing certain assets without satsifying the lien.

Common Questions About Tax Liens

The complexities surrounding tax liens often lead to numerous questions. Here are some frequently asked questions:

- What triggers a tax lien? - A tax lien is triggered when you neglect or fail to pay a tax debt after the IRS has assessed your liability and sent you a bill that you ignored.

- How does a tax lien affect my credit? - Although tax liens no longer appear on credit reports, they can still impact your ability to secure loans or lines of credit as they are public records.

- I received a Notice of Federal Tax Lien Filing - What do I do? ACT FAST. These notices offer taxpayers an opportunity to appeal and request a hearing by a DEADLINE set forth in the notice. Don't miss the deadline. Consult a tax lawyer to discuss your rights.

- Can I have a tax lien removed? - Yes, paying your tax debt in full, setting up a direct debit payment plan when you owe $25,000 or less , in limited circumstances, satisfying the terms of an IRS accepted offer in compromise, or disputing the lien with valid evidence (very rare), can lead to removal of the lien. There are also ways to apply to get the lien removed in order to close on a loan or sell property, through applications for certificates of subordination or discharge, depending on the circumstances. These are often complex processes and an experienced tax lawyer is important for a successful outcome.

The Role of a Tax Attorney

When facing a tax lien, having a tax attorney can make a big difference. A tax attorney can navigate the complexities of federal tax liens and provide valuable support in resolving your lien issues.

How Can a Tax Attorney Help?

A tax attorney can assist in multiple ways, including:

- Applying for a Certificate of Subordination or Discharge: An experienced tax lawyer can help you close on your loan or real property transaction as quickly as possible. I have assisted numerous taxpayers over the past 25+ years with successful applications for subordination or discharge, allowing them to close on their loan or property transaction.

- Applying for a Certificate of Withdrawal. They can help you get the federal tax lien withdrawn from the public record if you qualify, such as in the case of an erroneous lien or a fully paid offer in compromise.

- Negotiating with the IRS: They can help negotiate payment plans or settlements on your behalf.

- Legal Representation: If your case escalates, having a tax attorney ensures you have representation before IRS collections, IRS appeals, U.S. Tax Court, or another court if appropriate.

- Expert Advice: A tax attorney can offer advice on minimizing future tax liabilities and avoiding potential future liens.

Benefits of Local Expertise

Hiring a San Antonio-based tax attorney provides the added advantage of local expertise, which can expedite the resolution process. This is particularly important if your case has been assigned to a local revenue officer so that, in some cases, the tax attorney can meet with the revenue officer before the lien is filed.

A local tax attorney also offers the convenience of face-to-face consultations, ensuring clear communication and a personalized approach tailored to your unique situation. This personal touch can be pivotal in managing the stress and complexity of dealing with a federal tax lien.

Taking Action

If a federal tax lien has been filed against you or if you are concerned about the possibility of one, it is essential to act promptly. Consulting with a tax attorney can provide peace of mind and set you on a path to resolving your lien issues as quickly and efficiently as possible. Don't wait until the situation worsens; seek professional guidance today.

Remember, understanding and addressing a tax lien is not just about resolving current issues but also about safeguarding your financial future. With the right assistance, you can navigate these challenges effectively and regain control over your financial health. Call me at 210-447-7572 or email me at [email protected] for a free consultation.